18+ Calculate The Covariance Between Profits And Market Capitalization

Web Enterprise Value or EV for short is a measure of a companys total value often used as a more comprehensive alternative to equity market capitalization. Web Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

Full Article Measuring Iconicism Through The Iconic Species Scale

We collected 2 years of data from Chinese stock market and proposed a comprehensive customization of feature engineering and deep learning-based model for predicting price trend of stock markets.

. Web THE most disturbing aspect of the current financial crisis is that no US. Web The information required by paragraph e of this Item shall not be deemed to be soliciting material or to be filed with the Commission or subject to Regulation 14A or 14C 17 CFR 24014a-1-24014a-104 or 24014c-1-24014c-101 other than as provided in this item or to the liabilities of section 18 of the Exchange Act 15 USC. Web A positive beta does not mean that a stock is going up in price.

The maximum value of T in Eq. An Overview 207 Background for Capital Market Theory 208 Developing the Capital Market Line 208 Risk Diversification and the Market Portfolio 212 Investing with the CML. Web The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

The purchases of stock in trade were Rs 6000 Cr. Experts variously attribute the economic reverses to subprime lending derivative trading excessive leverage and regulation that was either too lax or too strict take your pick but these are symptoms rather than causes. Web Enter the email address you signed up with and well email you a reset link.

Web Panel B of Fig. Web CHS describe this sign switch presumably as a result of the previously noted correlation between this variable and market capitalization but do not elaborate on why the covariance pattern is different from that at shorter horizons. At both λ 0 and λ 1 we have T 0 because all investors hold the market portfolio.

1 plots the difference between the yields of green and non-green bonds also known as the greenium eg Larcker and Watts 2020The greenium is always negative averaging 46 bps and ranging mostly between 7 and 2 bps per year. Hence Cost of Goods Sold can be calculated as. Must contain at least 4 different symbols.

Web An Introduction to Asset Pricing Models. Web Enter the email address you signed up with and well email you a reset link. Cost of Goods Sold Beginning Inventory Purchases during the year Ending Inventory.

Web Firms with marginal costs exceeding this level will earn negative profits and exit. S 30 y 30 L 30 y 18 L 18 2 Then the forecasting k periods into the future is. When the market is trending lower these stocks will tend to rise.

Web Suppose we wish to calculate seasonal factors and a trend then calculate the forecasted sales for July in year 5. 6 to 30 characters long. Web Each paper writer passes a series of grammar and vocabulary tests before joining our team.

207 Capital Market Theory. 54 always occurs at λ 05 the maximum of λ 1. Web Enter the email address you signed up with and well email you a reset link.

Web Enter the email address you signed up with and well email you a reset link. Official has correctly identified its primary cause. Web thuythesiscapm-13127243549903-phpapp01-110807085837-phpapp01 - Free download as Word Doc doc docx PDF File pdf Text File txt or read online for free.

We have calculated the alpha of Middle Quintiles - Quintile 1 and Quintile 5- Middle Quintiles portfolio. Web TSS R2 must lie in the interval 0 R2. Enterprise value is calculated as the market.

5 plots T for different values of λ and ΔIn Panel A λ goes from zero to one. Web Lets take an example of HUL and assuming for the year 2017-18 beginning inventory was Rs 12000 Cr and the ending inventory was Rs 15000 Cr. In fact a stock that has a high beta while the market is falling is more than likely falling at a higher percentage rate than the market.

6 Therefore for investors holding the bonds to maturity the green bond always has a. F nk L n k. Globalization which increases effective market size or greater competition meaning higher substitutability between varieties of goods will tend to make markets tougher and reduce the cut-off c causing low-productivity firms to shrink and exit.

Likewise a negative beta does not mean that a stock is going down in price. Web Free essays homework help flashcards research papers book reports term papers history science politics. Web Statistics for business economics by and.

The market capitalization of a company is simply its share price multiplied by the number of shares a company has outstanding. ASCII characters only characters found on a standard US keyboard. Web The global market size book-to-market and momentum factors are the weighted average of the respective country-specific factors where the weight is the lagged total market capitalization in that country.

An Example 215 The Capital Asset Pricing Model 216 A Conceptual Development of the CAPM 217. As applied researchers in business and economics faced with the task of predicting. We also note that there is a weaker sensitivity to recent stock returns of DSW3 when compared to DSW1.

Web In the era of big data deep learning for predicting stock market prices and trends has become even more popular than before. Again we see that dispersion in ESG tastes is needed for an ESG investment industry to exist.

Hw1 Solution Name Class Date First Page Studocu

Legal Cannabis Market Shares During Canada S First Year Of Recreational Legalisation Michael J Armstrong Associate Professor

Factors Influencing Cryptocurrency Prices Evidence From Bitcoin Ethereum Dash Litcoin And Monero Sovbetov Journal Of Economics And Financial Analysis

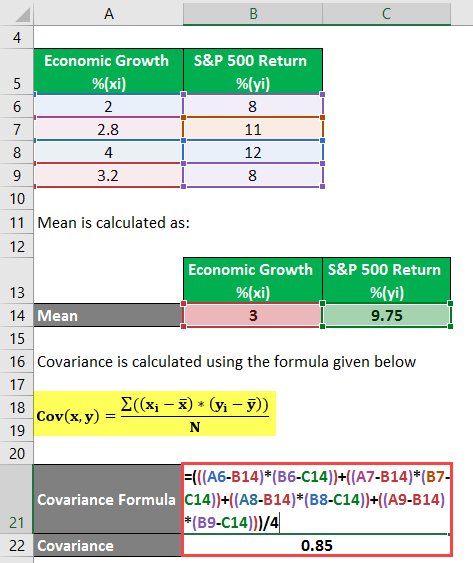

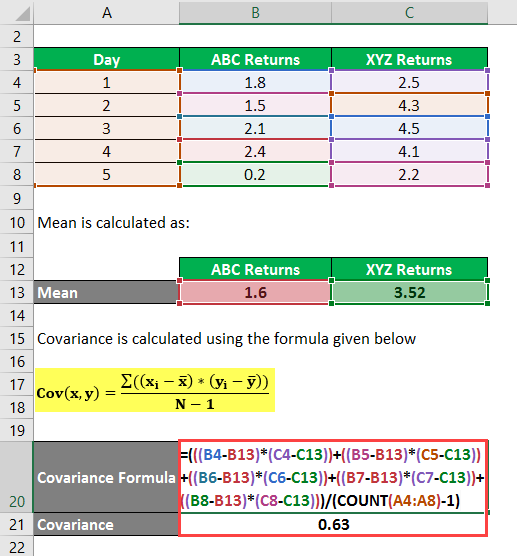

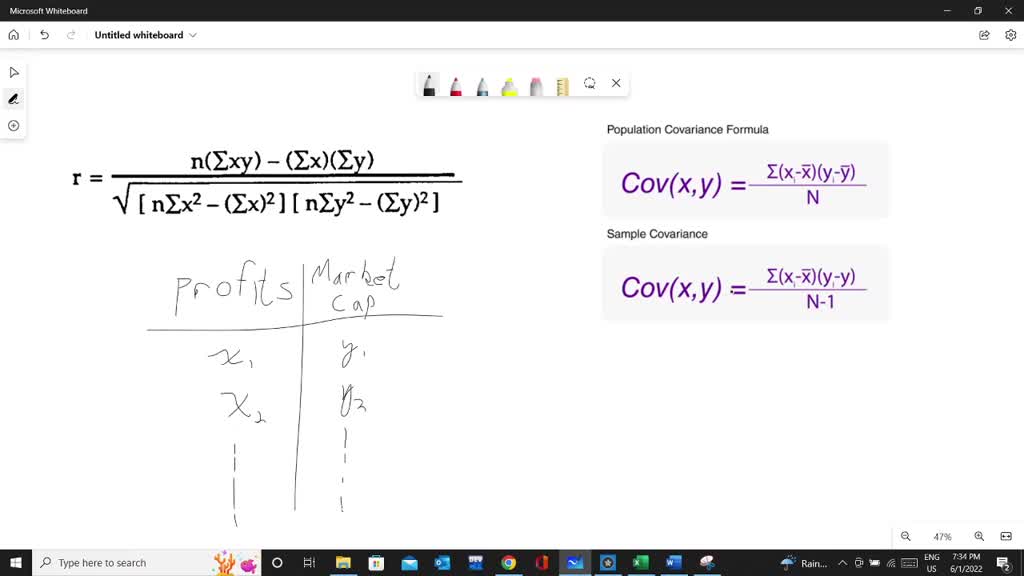

Covariance Formula Examples How To Calculate Correlation

Covariance Formula Examples How To Calculate Correlation

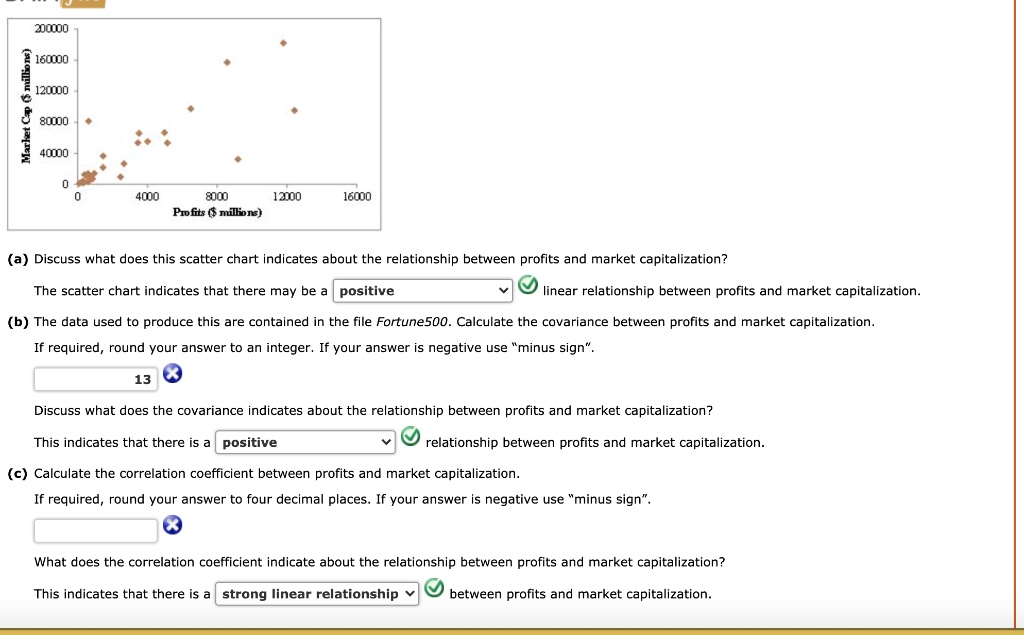

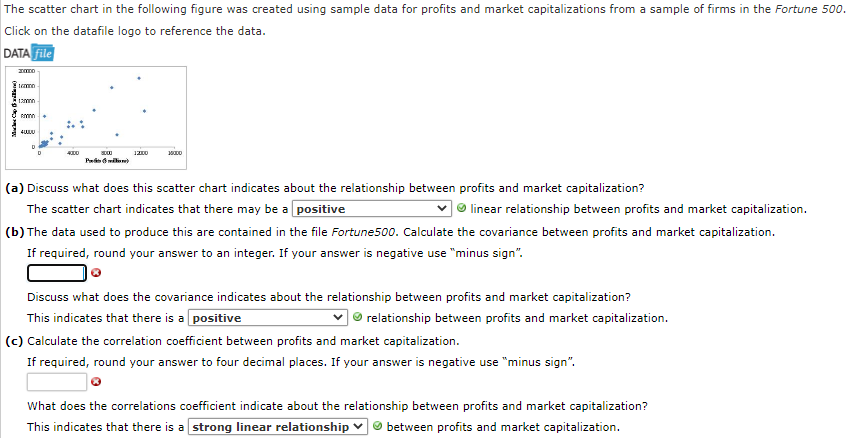

Solved The Scatter Chart In The Following Figure Was Created Using Sample Data For Profits And Market Capitalizations From Sample Of Firms In The Fortune 500 Click On The Datafile Logo To

Covariance Calculator Mathcracker Com

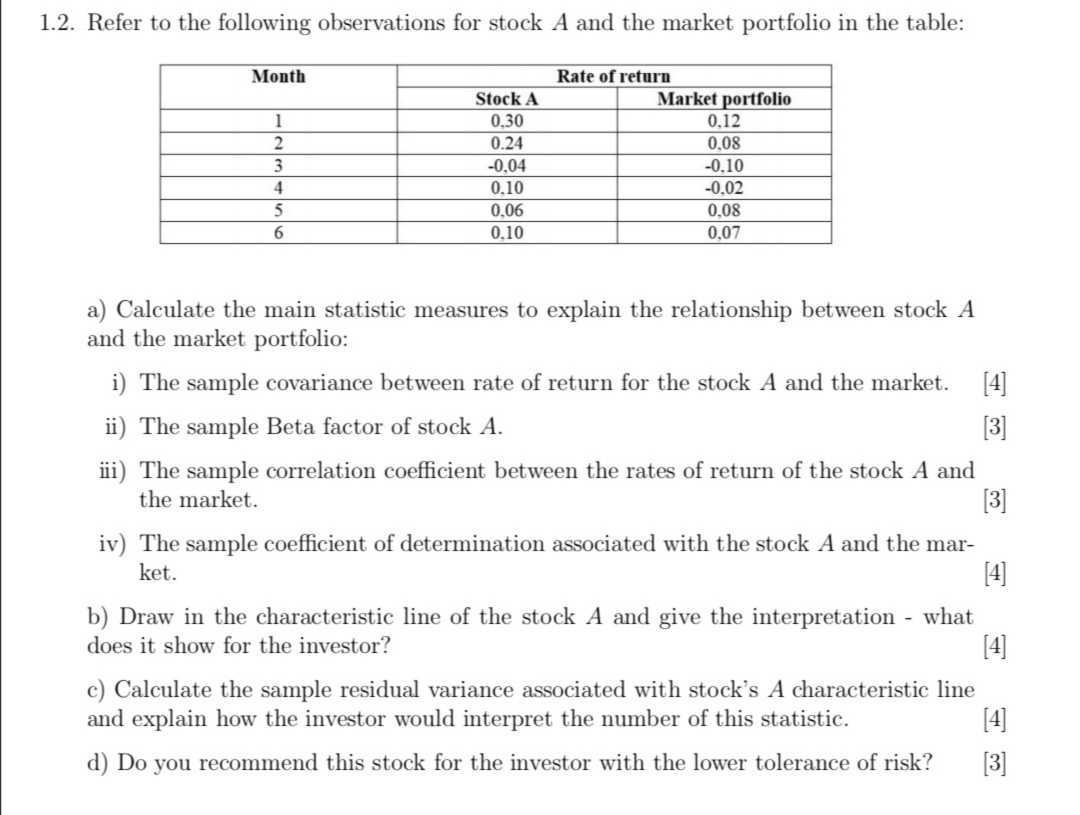

Answered 1 2 Refer To The Following Bartleby

Solved Dooo 160000 12000 80000 40oo 400 M0 1300 Pmfits Milions I6600 A Discuss What Does This Scatter Chart Indicates Bout The Relationship Between Profits And Market Capitalization The Scatter Chart

Consider The Following Sample Data X 25 18 20 12 22 Y 27 20 25 15 22 A Calculate The Covariance Between The Variables Negative Value Should Be Indicated By A Minus

Is There A Way To Forecast Forex Mathematically Quora

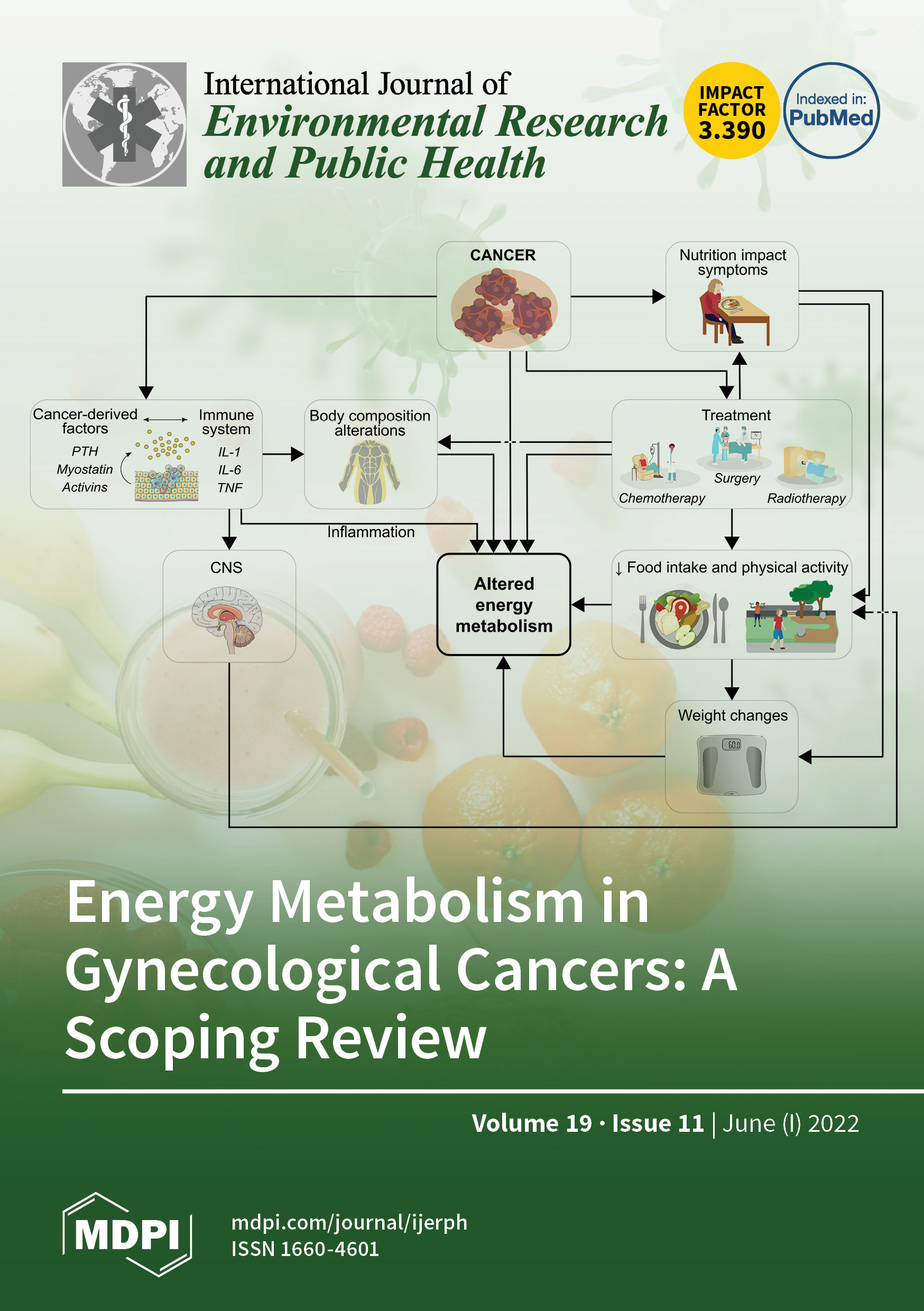

Ijerph June 1 2022 Browse Articles

Solved The Scatter Chart In The Following Figure Was Created Chegg Com

References A Guide On Data Analysis

Ex151puretechhealthannua Annual Transition Report 20 F

The Role Of Corporate Image And Switching Barriers In The Service Evaluation Process Evidence From The Mobile Telecommunications Industry Emerald Insight

Hw1 Solution Name Class Date First Page Studocu